Net present value of annuity

N number of. R rate of return.

How To Calculate The Present Value Of An Annuity Youtube

The higher the discount rate the lower the present value of the annuity.

. Ad Get this must-read guide if you are considering investing in annuities. Learn More On AARP. C 1 cash flow at first period.

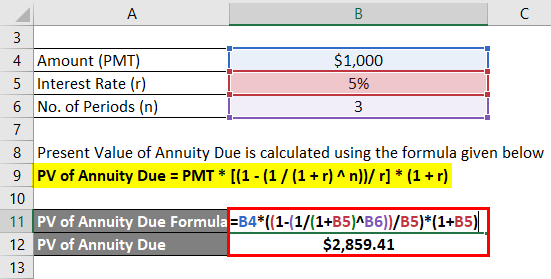

To find the future and present values of an annuity due multiply the applicable formula by 1 k to reflect the earlier payment. NPV is the net present value of each project under evaluation PVIFA is the present value of interest factor annuity Step 3. Learn some startling facts.

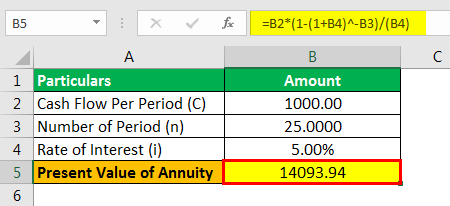

Accordingly use the annuity formula in an electronic spreadsheet to more precisely calculate the correct amount. A Fixed Annuity May Provide A Very Secure Tax-Deferred Investment. Ad A Calculator To Help You Decide How A Fixed Annuity Might Fit Into Your Retirement Plan.

The present value of an annuity is the cash value of all of your future annuity payments. Ad See If An Annuity Is Right For You. The rate of return or discount rate is part of the calculation.

This would be a. The present value interest factor of annuity is a factor that can be used to calculate the present value of a series of annuities. Ad Learn More about How Annuities Work from Fidelity.

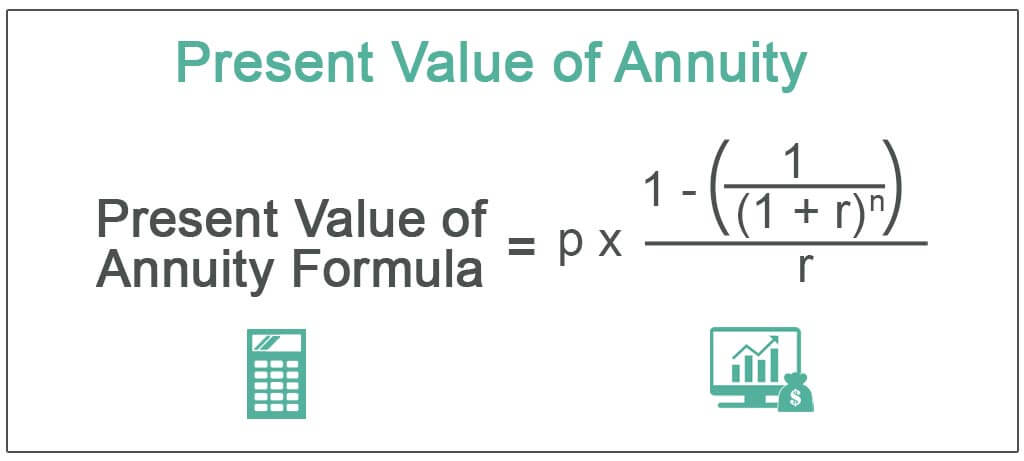

Ad Learn More about How Annuities Work from Fidelity. The present value of annuity formula relies on the concept of time value of money in that one dollar present day is worth more than that same dollar at a future date. Here is the present value of an annuity formula for annuities due.

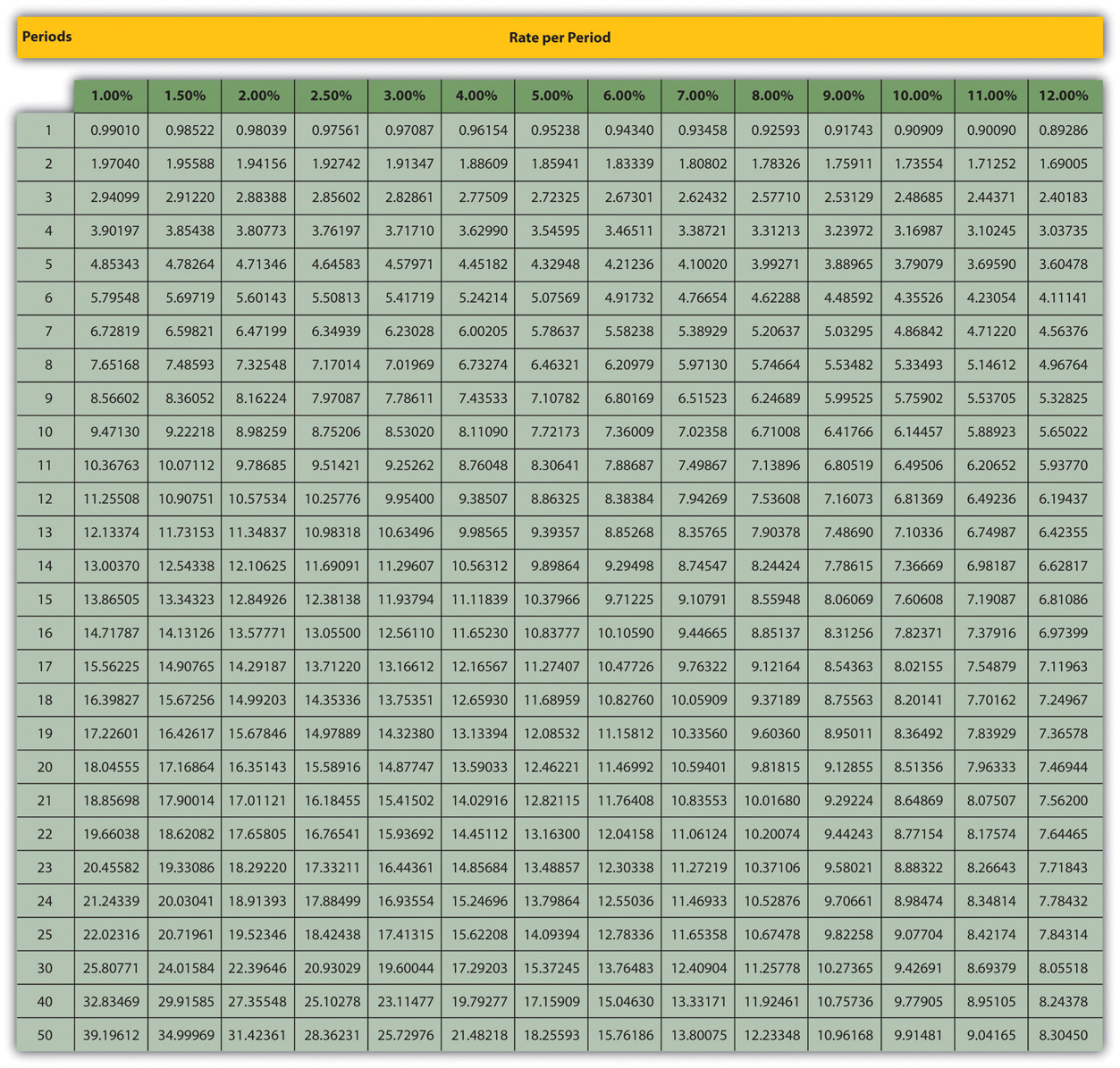

Rate Per Period As. Annuities are often complex retirement investment products. The payment variable can be taken out of the formula to determine the factor.

PV the Present Value. Dont Buy An Annuity Without Knowing The Hidden Fees. The formula for calculating the present value of an.

Now we will look at the alternate formula for Present Value of Annuity as well. A simple example of a growing annuity would be an individual who receives 100 the first year and successive payments increase by 10 per year for a total of three years. Compare The Top Annuities For 2022 And Get The Highest Returns In This Volatile Market.

P PMT x 1 1 1 r n r Where. If youve got the selection of being paid 1000 today or 1200 one year from now. The present value of an annuity is determined by using the following variables in the calculation.

Example of Present Value. Present Value PMT x 1 - 1 r -n r x 1 r Where PMT is the value of the cash flows. More Guaranteed Lifetime Withdrawal.

Because payments for an annuity due are. R is the constant interest. This formula shows that if the present value of an annuity due is divided by 1r the result would be the extended version of the present value of an ordinary annuity of.

Select the project with the highest annualized NPV As. P the existing value of the annuity stream. By having a table that consists of the various factors associated with given rates and periods.

What Is An Annuity Table And How Do You Use One

Annuity Present Value Pv Formula And Calculator Excel Template

Present Value Pv Of An Ordinary Annuity Formula With Examples Time Value Of Money Youtube

Present Value Of A Growing Annuity Formula With Calculator

Present Value Of An Annuity How To Calculate Examples

Present Value Of An Annuity Definition Interpretation

Present Value Of Annuity Formula With Calculator

Present Value Of An Annuity How To Calculate Examples

Annuity Present Value Pv Formula And Calculator Excel Template

11 3 Present Value Of Annuities Mathematics Libretexts

Present Value Of Annuity Formula Calculate Pv Of An Annuity

Present Value Of Annuity Formula Calculate Pv Of An Annuity

Appendix Present Value Tables Financial Accounting

Present Value Formula And Pv Calculator In Excel

Present Value Of Annuity Due Formula Calculator With Excel Template

Excel Formula Present Value Of Annuity Exceljet

Present Value Of Annuity Due Formula Calculator With Excel Template